Stablecoin payments and fintech platforms, Foundations, on-chain investors and trading platforms hold significant stablecoin balances that sit idle, leaving meaningful returns on the table. Multiliquid allows treasury teams to deploy these holdings into yield-bearing tokenized assets and exit instantly when capital is needed. No redemption delays, no compromise between yield and liquidity.

02

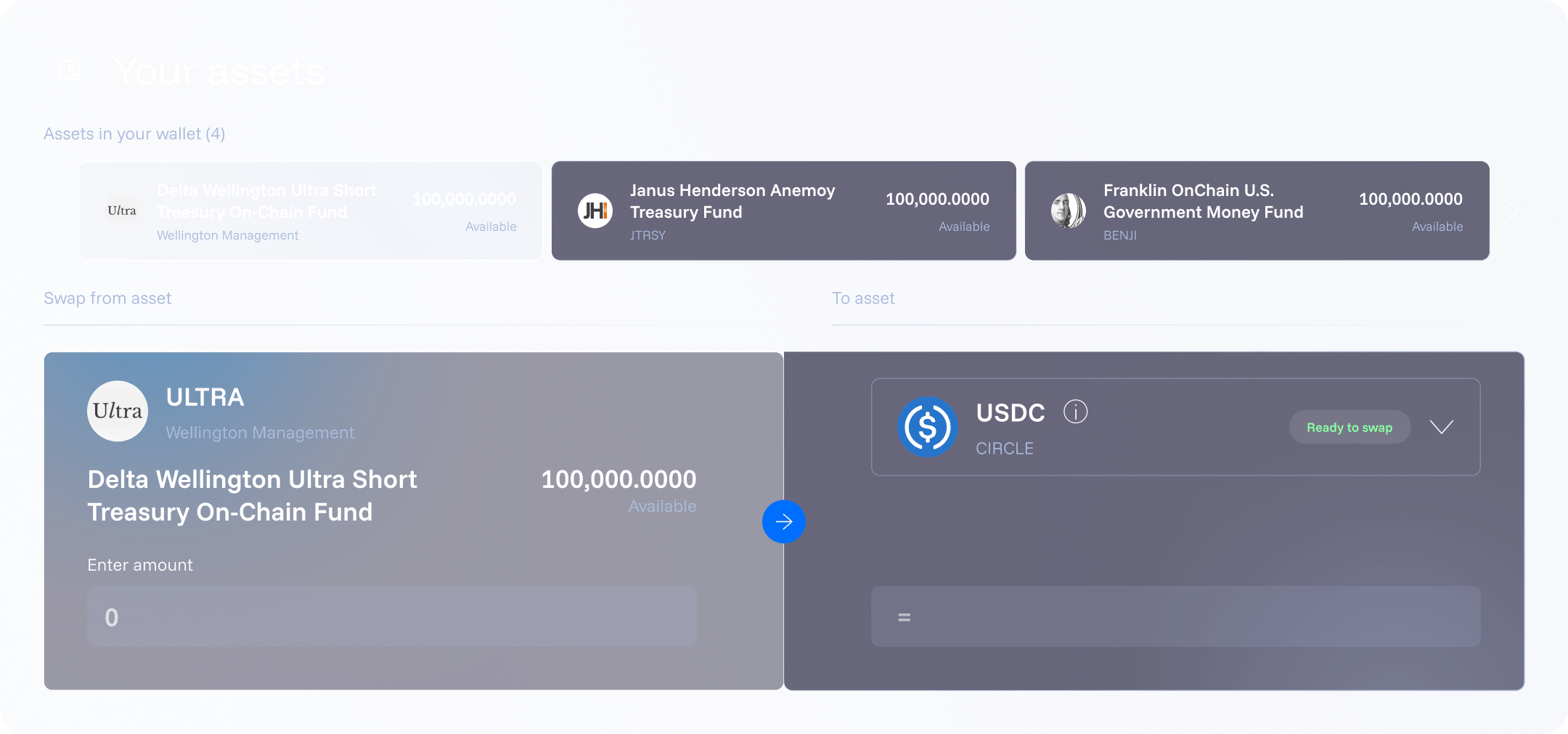

Instant RWA Redemptions

Low liquidity in tokenized assets limits investor adoption and DeFi interoperability. Multiliquid enables RWA investors, curators and DeFi lenders to instantly exit positions with certainty against deep stablecoin liquidity.

Tokenized asset issuers often face operational friction from redemption processing, while at the same time slow redemptions throttle distribution reach. Multiliquid provides instant liquidity capabilities for tokenized assets, allowing holders to exit positions without creating redemption queues. The result: reduced operational burden for issuers, broader access for investors, and seamless interoperability with the stablecoin ecosystem.